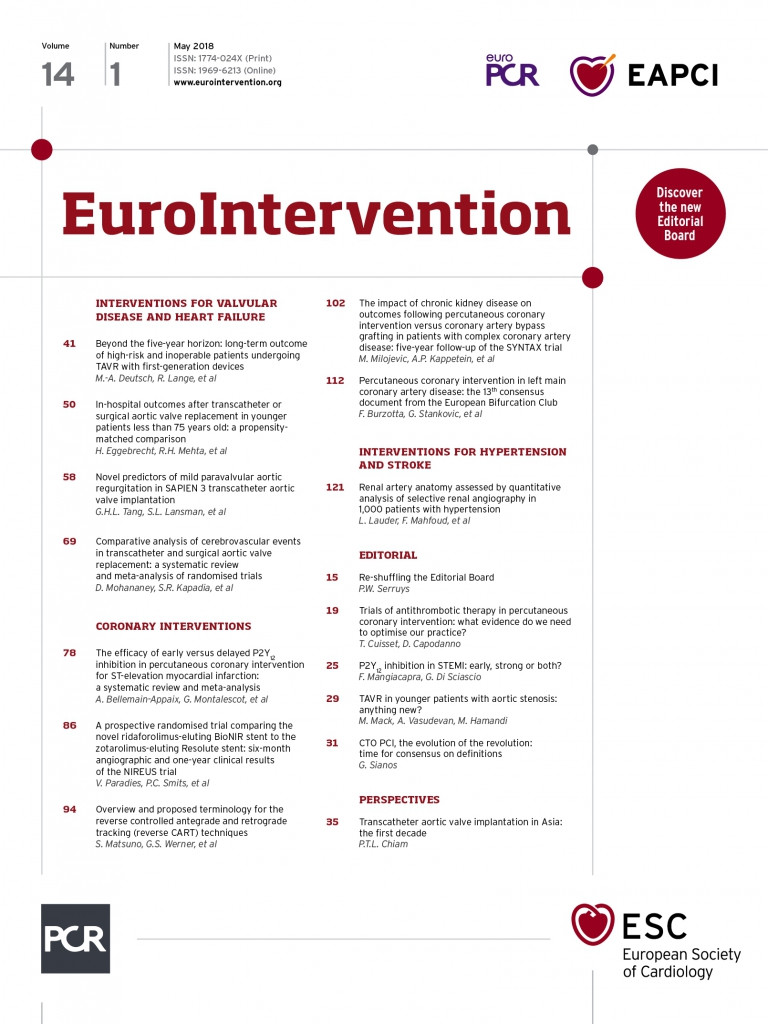

Last year, the interventional cardiology community commemorated the 15th anniversary of the birth of transcatheter aortic valve implantation (TAVI)1. Since European commercial approval was granted in 2007, the expansion and uptake of TAVI in Europe has been phenomenal2.

In comparison, TAVI only reached the shores of Asia two years later, when the procedure was first performed in Singapore in February 2009, using the SAPIEN valve (Edwards Lifesciences, Irvine, CA, USA)3. Subsequently, CoreValve® (Medtronic, Minneapolis, MN, USA) was launched commercially in Malaysia in October 2009. Over the next one to two years, TAVI spread across the diverse Asian region from Southeast Asia (Singapore, Malaysia, Philippines) to Northeast Asia (Hong Kong, South Korea, Taiwan).

The adoption of TAVI was initially met with resistance by some in the cardiac surgical community. Coupled with the lack of randomised trial data at that time and the prohibitive cost of the valve (most countries in Asia do not reimburse the cost of TAVI), its take-up was slow. Indeed, early TAVI centres across Asia found it challenging to gain a large experience due to the low case volume.

It was only after the publication of randomised trials demonstrating that TAVI was a treatment option for high and intermediate surgical risk patients with severe aortic valve stenosis (AS)4-7 that case numbers began to rise. Another reason for the more rapid growth in the past few years is undoubtedly the availability of the newer-generation valves in Asia – Evolut™ R (Medtronic) in January 2015 and the SAPIEN 3 (Edwards Lifesciences) in October 2015. The wider range of valve sizes and the smaller profile delivery sheaths enabled the vast majority of Asian patients to be treated via the transfemoral approach despite their smaller iliofemoral anatomy8.

The other factor that has contributed to the rapid growth of TAVI in Asia in the last five years is the commercial approval (with full reimbursement) in Japan in October 2013, resulting in the rapid expansion of TAVI centres (≈137 centres at the last count). In contrast, there are ≈120 centres performing TAVI across the rest of Asia! From ≈1,000 cases across Japan in the first year after TAVI approval, ≈5,000 cases were performed in 2017 (≈40 cases per million inhabitants). Comparatively, the corresponding figures for other “higher-volume” countries in Asia are: Hong Kong ≈14/million, Singapore ≈16/million, South Korea ≈10/million, and Taiwan ≈12/million. Why might there be such a disparity in case volume? First, the procedure is fully reimbursed in Japan (for eligible high surgical risk patients), whereas public funding is minimal and payment is mostly out-of-pocket in the other Asian countries. The other important but often overlooked reason is the demographics of the various Asian regions. For example, Japan has the greatest proportion of elderly citizens (>65 years) at 27.4%, followed by Hong Kong (14.2%), South Korea (13.5%), Taiwan (12.5%), Singapore (11.2%) and China (10.8%). In comparison, the corresponding figure in a developing country such as India is only 4.9%. It thus becomes apparent why there is a large difference in the case volumes across Asia since most of the TAVI candidates are likely to be of advanced age. Also, in socioeconomically less developed Asian countries, TAVI is simply too costly for patients to afford and surgery would be the preferred (lower cost) option. As societies in Asian countries mature and age, and their economies become more affluent, we can anticipate that TAVI has room for tremendous growth.

To place things in perspective, three years ago in 2015, the corresponding TAVI volume figures were already ≈164 TAVI cases per million in Germany, ≈39 cases per million in the United Kingdom and ≈23 cases per million in Ireland. Thus, the current TAVI procedure volume in Japan appears to be similar to the European average. This may however change swiftly as the case volume in Japan will definitely increase once reimbursement approval is obtained for intermediate surgical risk patients.

One of the most striking differences with TAVI patients in Asia is the smaller Asian physique as compared to the Western population. Chiam et al demonstrated that the iliofemoral dimensions were generally smaller in Asians, particularly in females8. The OCEAN-TAVI Japanese registry reported that Japanese patients had a smaller annulus area, lower coronary ostium heights and narrower sinus of Valsalva as compared to a French population9. These are important considerations, as the smaller Asian anatomy may theoretically increase the risk of vascular access complications, aortic root injury and coronary occlusion. Smaller valves are therefore used more frequently in Asian patients9. As such, the need for smaller profile devices is greater in Asian patients to minimise vascular complications.

It is our hope that industry partners make future new-generation (smaller profile) devices available to Asia as soon as they become approved to benefit and reduce procedural risks in Asian patients. The current model where newer-generation devices are made available to Asia months or even years after European/U.S. approval should be reconsidered. Economics has been the determining factor – lower case volume in Asia relegates it to a lower priority for newer device introduction – yet it is precisely the lower volume centres (with Asian patients who probably have a smaller physique) that will have a greater need for these newer devices to achieve good outcomes.

Although TAVI in a bicuspid AS was first performed in Asia nearly a decade ago10, there has been significant interest recently as several reports indicate a high proportion (≈47%) of bicuspid valves among Asian TAVI patients, mainly in China11. In fact, selected centres in China may arguably now have the largest experience with TAVI in bicuspid AS. However, informal discussions among TAVI operators seem to suggest that ethnic Chinese outside of China (Hong Kong, Singapore, Taiwan), do not have a similarly high prevalence of bicuspid anatomy. Whether the high incidence of bicuspid anatomy in China is due to regional factors (e.g., diet, social habits, environment, etc.) or the fact that the TAVI population in China is generally younger (and thus more likely to be of bicuspid aetiology) remains to be elucidated.

In keeping with the global experience, TAVI has also been applied in Asia to other off-label indications such as degenerated surgical bioprosthesis (valve-in-valve TAVI)12, pure aortic regurgitation13, and non-calcific AS14. One form of non-calcific AS that would be encountered more frequently in Asia than in Western nations is that of rheumatic AS.

Although rheumatic heart disease has been declining in incidence over the past few decades, it is still relatively prevalent in several developing countries of Asia (e.g., India, Vietnam, Indonesia, etc.). There have been several reports of TAVI in rheumatic AS and it appears that TAVI is feasible despite a lack of leaflet or annular calcification15. In this author’s limited experience of seven cases of rheumatic AS (using either the SAPIEN or CoreValve prostheses), TAVI was successful in all cases with durable results at one year (unpublished data).

Other valves that have been used or are in commercial use in Asia include the Lotus™ valve (Boston Scientific, Marlborough, MA, USA – now withdrawn), the Symetis ACURATE valve (Boston Scientific), the JenaValve (JenaValve Technology GmbH, Munich, Germany), and the Portico™ valve (Abbott Vascular, Santa Clara, CA, USA), but the numbers have been small. In China, none of the commonly used valves has been approved for commercial use. Interestingly, several locally developed Chinese valves have already undergone trials as mandated by the Chinese health authorities, and two have achieved commercial approval – the transfemorally delivered self-expanding Venus A-valve (Venus Medtech, Hangzhou, China, approved April 2017) and the transapically delivered J-Valve™ (JC Medical Technologies, Suzhou, China, approved June 2017).

One other device that has been used recently in Asia is the Sentinel™ cerebral protection device (Claret Medical, Santa Rosa, CA, USA) to reduce cerebral emboli to the brain during TAVI. It was introduced in 2017 and early experience is currently limited to only two centres (one in Hong Kong, the other in Singapore). Although trial data appear promising16, its uptake in Asia remains uncertain. Scepticism among physicians, additional cost (to an already very expensive procedure) and challenges in logistic support and physician training may limit its use and market penetration.

As TAVI (and in parallel, other forms of transcatheter valve therapy such as the MitraClip® [Abbott Vascular]) becomes increasingly established and widespread in Asia, several dedicated valve meetings and courses have been developed and are now organised on a regular basis (e.g., PCR Tokyo Valves, CIT-PCR China Valves, China [Hangzhou] Valves, AP Valves, etc.). These serve to provide a forum for educating cardiologists and cardiac surgeons interested in catheter-based valve therapy and also act as a platform to learn from one another’s experience about unique Asian perspectives in TAVI. Publications of the TAVI experience in Asians have increased in recent years with most of the contributions coming from the Japanese OCEAN-TAVI registry. Further research may yet uncover other unique characteristics of TAVI in Asians and there are now several national registries tracking TAVI procedures in various Asian countries. The Asian Pacific Society of Interventional Cardiology (APSIC) has a similar initiative where information will be collected from many countries across Asia to produce a data set that will be pan-Asian and not limited to a specific ethnic group.

TAVI has come a long way in Asia since its slow start a decade ago. From a few centres in the initial years, TAVI is now performed in approximately 260 centres throughout Northeast Asia, Southeast Asia and the Indian subcontinent. As the experience in Asia grows, and as the population in Asia continues to “grey”, TAVI is poised to grow rapidly in the near future. As most Asian countries (apart from Japan) are unlikely ever to receive full reimbursement for TAVI procedures, the device cost would be the major determining factor for the expansion and uptake of the procedure. If the cost of the valve could be reduced and priced similarly to European benchmarks (currently, valves in Asia are priced at a significant premium), it may not be far-fetched to envisage a future scenario where the number of TAVI procedures in Asia surpasses that in Europe.

Conflict of interest statement

Paul T.L. Chiam is a consultant/proctor for Medtronic CoreValve.