The device market in the developed world is stagnating. Emerging markets on the other hand are witnessing a year-on-year, double digit growth. An ageing population, shifting disease pattern, increased health awareness, growing private hospital sector, increasing local government support and expenditures –but most importantly a growing middle class– have all contributed to this phenomenal growth.

Multinational companies (MNCs) are cashing in on this growth, but their strategy is primarily focused on the premium customer segment with pre-existing high-end models, completely ignoring the middle class. Local device industry, on the other hand, is investing more on economically viable products based on an understanding of local needs. Further, they are benefiting from faster evaluation times for their products and slow, but definite improvement in the regulatory environment in the developing world.

Innovation is the key for the device industry

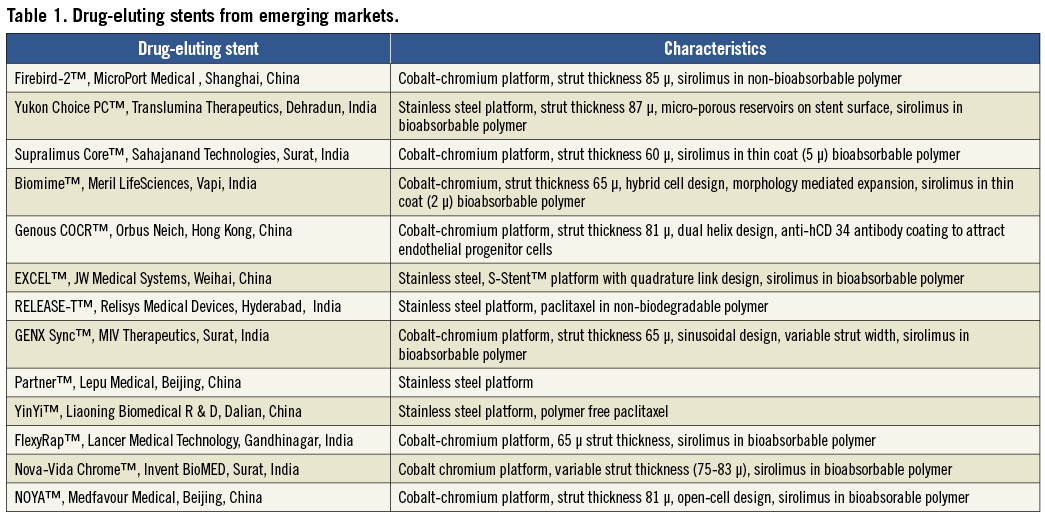

While cost issues are important, the future of these local device companies will perhaps depend not so much on cost effectiveness but on their ability to innovate in the market. These innovations will have to be across the entire value chain, in the areas of product, process, business model, service delivery, technology etc. Indian companies themselves have focused more on product innovation (Table 1).

Product innovation

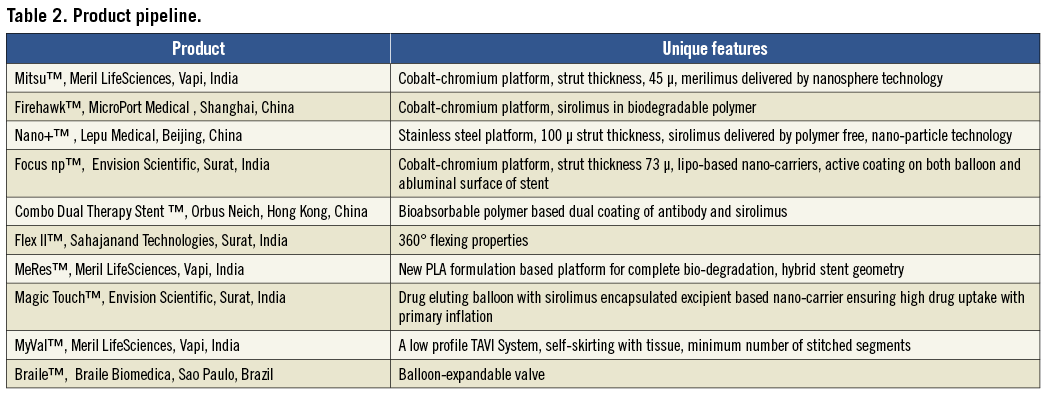

In the field of drug-eluting stents (DES) there are three components to a DES: the stent platform, the polymer and the drug. Most of the innovation involves the area of bioabsorption. Conceptually, bioabsorption is very attractive because in the long run it leaves no foreign material behind. There is no possibility of a toxic drug/polymer remaining in the body (which may contribute to late stent thrombosis) and it also obviates the need of a prolonged dual antiplatelet therapy1. It is especially attractive in the Indian context because of the younger age at which patients present as well as issues of drug compliance. The BVS™ stent from Abbott Vascular in Santa Clara CA, USA is completely bioabsorbable. Most Indian companies are also focusing on this area. Yukon Choice PC™ from Translumina Therapeutics, Dehradun, India has microporous reservoirs on the stent surface which reduces the requirement of polymer. Others have developed advanced polymer technology which is not only bioabsorbable, but also requires a very thin coat; Biomime™, Meril LifeSciences, Vapi, India; Supralimus Core™, Sahajanand Technologies, Surat, India and GENX-Sync™, MIV Therapeutics, Surat, India, are some examples. Like MNCs, their future products envisage more and more bioabsorbability, culminating in a completely bioabsorbable stent (Table 2).

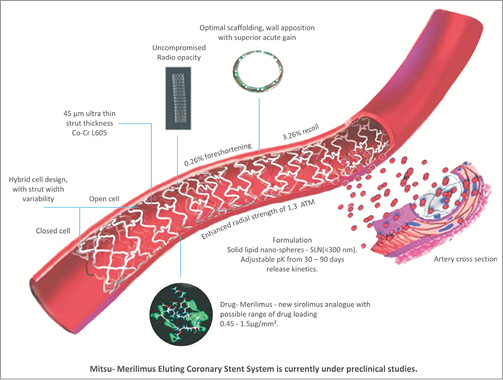

The second area of innovation has been stent structure and design. Practically all Indian companies have delved into this aspect of stent development with most of them moving to a lower strut thickness. The strut thickness of Biomime™ and GENX-Sync™ is 65 µ. The strut thickness of Supralimus Core™ is only 60 µ, compared to the strut thickness of standard stents like XIENCE V™ (Abbott Vascular) or PROMUS Element™ (81 µ) (Boston Scientific, Natick, MA, USA) , Resolute Integrity™ (91 µ) (Medtronic Inc., Minneapolis, MN, USA). There is evidence that lower strut thickness can contribute to lower restenosis rates. Interestingly, stents with lower strut thickness are also more deliverable. Thus it is not surprising that most of these stents are available in longer stent lengths; up to 40 mm (Biomime™ and GENX-Sync™). This entails the delivery of a single stent for long lesions instead of two, contributing to significant cost saving. The downside is that lower stent strut thickness is linked to lower radial strength and thus a tendency to stent fracture. Innovative stent designs have attempted to overcome this weakness. The Meril group of stents have hybrid cell design structures which impart radial strength and allow for better conformability and less vessel wall injury (Figure 1). Orbus Neich, Hong Kong, China has pioneered the concept of the pro-healing stent. The Genous™ stent incorporates endothelial progenitor cell capture technology which might confer antithrombotic and antirestenotic properties. Besides DES, several companies are also working on newer products keeping in mind evolving fields like drug-eluting balloons and transcutaneous aortic valves (Table 2).

Figure 1. Design of Mitsu - Merilimus-eluting stent.

Business model innovation

Chinese companies have taken a different approach to innovation. They have innovated in their business model. The Firebird™ stent from MicroPort Medical, Shanghai, China, featured in this issue of EuroIntervention is a case in point2. This stent has shown equivalent results to the best currently available DES. However, popularity in China is not dependent on pricing but on more local support and on a more sustainable and adaptable business model. Other companies such as Orbus Neich, Hong Kong, China; JW Medical, Weihai, China; Lepu Medical, Beijing, China, etc. all have robust business models as well. As a result, currently, local companies are holding >75% of DES market in China3. Lately, these companies have also realised the importance of product innovation and most of them are now developing “futuristic” products (Table 2).

In India, on the other hand, the business model has evolved around the burgeoning middle class who cannot afford to splurge on healthcare but will spend if absolutely necessary. Since most of the customers pay from their own pockets (with only ~10% employee insurance and ~10% private insurance), schemes which entail one-time payment of health costs such as a life warranty are more attractive. Some Indian companies (Sahajanand Technologies and Meril LifeSciences) are offering limited period warranties on their products. Another strategy, similar to the pharmaceutical industry, is bulk manufacturing and selling as generic stents in an open market (MIV Therapeutics). A major challenge in this region lies in arranging the finances. It is here you will see several innovative micro-insurance schemes which will make healthcare more affordable to the middle class.

For MNCs the key to success may be outsourcing/relocating the manufacturing/R&D facilities –and even the trial industry– to emerging markets taking advantage of the low cost of production, skilled manpower, but also to decrease the distribution costs themselves. Bringing out the basic, “no-frills” model for the middle class may be another winning strategy. Finally, joint ventures and other collaborations may be the need of the hour. Several device companies have already started working along these lines, such as Translumina Therapeutics which moved its base from Germany to Dehradun in India. Another example is the effective collaboration between JW Medical and Biosensors Inc. in Singapore.

Quality issues

Currently, the basic limitation is that local companies have relatively new products with little long term clinical and safety data. Thus, it remains to be seen if, in the long run, they can reinvigorate the market and provide an effective alternative to current products. There are several areas where more progress is required. The quality of raw materials, processes and finished products are sometimes a concern. The rapid product evolution may also bypass some of the essential steps in product development. Thus a rigorous structural, physiological, pre-clinical and clinical evaluation should be undertaken. Today several companies have indeed obtained vigorous data favouring the use of their products, but certainly more needs to be done4-10. The regulatory processes have to be made stricter and consistent. Robust data in favour of the device should be made mandatory before the product is made available for marketing. Finally, there is the contentious issue of intellectual property rights, which may need to be judiciously resolved.

Conflict of interest statement

The authors have no conflicts of interest to declare.